Comparison of Mortgage Rates in Jamaica for Purchasing a Home

- By Tanya Thompson

- Aug 1, 2017

-

5m

-

39

- RSS

Interested in buying a new home? Want to know which financial institutions are offering the best mortgage rates in Jamaica today? We did. Here is what we found out when we went searching online and compared the various offers advertised by Jamaican mortgage providers.

We specifically focused on getting mortgages to purchase a home. As such, loans to build a new property, or to buy residential land, residential properties for investment purposes, and commercial properties were not assessed.

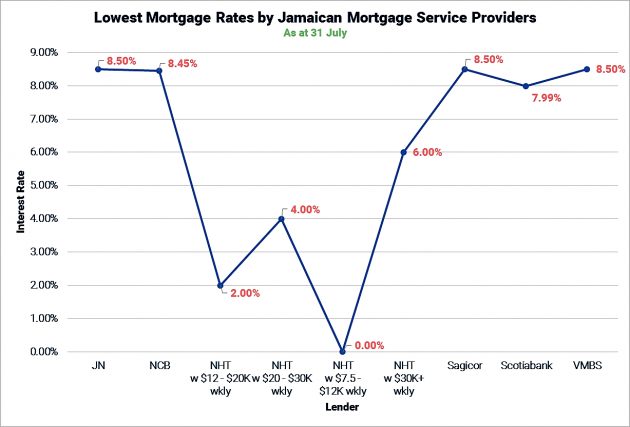

Lowest Mortgage Rates

Listed below are the lowest mortgage rates currently on offer from each Jamaican mortgage provider, if you are buying a new or existing dwelling to server as your primary residence.

| Lender | Interest Rates |

|---|---|

| JN Bank | 8.50% |

| National Commercial Bank | 8.45% |

| National Housing Trust1 | 2% to 6%, depending on your weekly income |

| Sagicor Bank | 8.50% |

| Scotiabank2 | 7.99% |

| Victoria Mutual Building Society | 8.50% |

| Note: |

- The National Housing Trust (NHT) only offers loans to qualified NHT contributors.

- Scotiabank has stated that this offer ends 31st July. The website page had not been updated prior to the publication of this article.

Purchase of a JMD $15 million home

Now let’s consider if you’re looking to purchase a Jamaican residential property valued at $15M.

The following table lists what is currently offered by the different Jamaican mortgage providers, outlining:

- The mortgage rates as advertised on each lender’s website.

- The minimum percentage of the loan amount you’ll need to provide as a down-payment as advertised on each lender’s website.

- The maximum number of years for which the loan would be provided, as advertised on each lender’s website1.

| Lender | Interest Rate | Down Payment | Max Term |

|---|---|---|---|

| JN Bank | 8.50% | 10% | 40 years |

| National Commercial Bank | 8.45% | 10% | 30 years |

| Sagicor Bank2 | 8.50% | 10% | 3 years. Fixed at 25 years. |

| Scotiabank3 | 7.99% | 5% | 30 years |

| Victoria Mutual Building Society4 5 | 8.50% | 10% | 35 years |

| Note: |

- The term offered for a mortgage depends on the age of the borrower. Loans may also not be approved if the borrower is older than a specific age (e.g., 60 years or more).

- Not sure what is meant by "3 years. Fixed at 25 years." and hung up after waiting on the phone for over 15 minutes to get an explanation from someone at Sagicor Bank. Sagicor Bank could be offering an interest rate of 8.50% for the first three years, after which they’ll discuss other options with you perhaps for another 25 years (e.g., to move to a higher or lower fixed rate, or a variable rate).

- Scotiabank has stated that this offer ends 31st July. The website page had not been updated prior to the publication of this article.

- Victoria Mutual Building Society indicates that eligible savers who save a 20% down-payment within a year can benefit from lower mortgage rates.

- We were unable to find the minimum down-payment on Victoria Mutual Building Society's website, and so assumed 10%.

- The loan limit from NHT is $5.5M, but if there are two NHT contributors you'll be able to borrow up to $9.8 million jointly. Check out our article announcing the increase in the NHT loan limit.

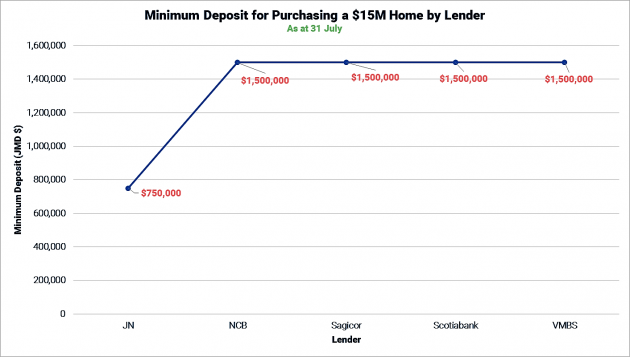

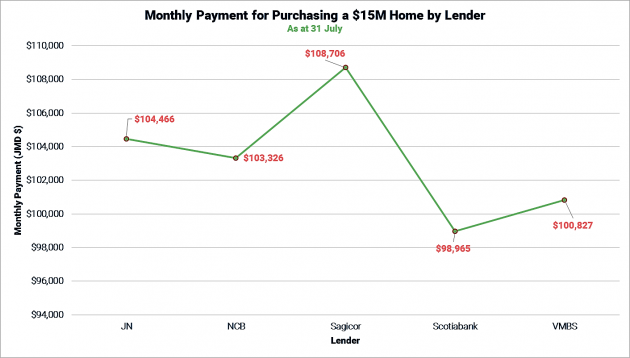

Now, how much do we need to pay up-front and during the term of the loan. More specifically, let's calculate the following:

- The amount of money you’ll need to repay each month.

- The minimum down payment amount you’ll need to save for your deposit.

The following table and charts show the results of our calculation. You can use our mortgage calculator to work out further details (e.g., the total repayment amount and total interest amount) and to vary the loan variables (e.g., mortgage rates, term) as you'd prefer.

| Lender | Min Deposit | Max |

|---|---|---|

| JN Bank | $750,000 | $104,466 |

| National Commercial Bank | $1,500,000 | $103,326 |

| Sagicor Bank1 | $1,500,000 | $108,706 |

| Scotiabank | $1,500,000 | $98,965 |

| Victoria Mutual Building Society |

$1,500,000 | $100,827 |

| Note: |

- For Sagicor, we’ve assumed a fixed rate of 8.50% for 25 years.

Other Bank Related Charges

DON’T RUSH OFF. With the information shown above, I know that some of you will now think that you know the best mortgage offering currently available. However, you need to bear in mind that there are other bank fees that you’ll need to pay with regard to processing and servicing the loan. You need to take all bank charges into consideration when you’re shopping around and when negotiating and selecting the best mortgage solution for you and your family.

Other Additional Costs

- There are a number of property transaction costs that you’ll need to fund (e.g., for stamp duty, transfer tax, and legal fees). These are up-front costs that must be paid before you can close the property sale.

- There will be costs for moving into, maintaining, and owning a Jamaican property (e.g., utility setup costs, painting, property tax).

Please don’t forget to factor in all the additional costs when budgeting for the purchase and care of your new Jamaican home.

This article is for general information purposes only and does not constitute legal, investment or other professional advice. You should seek the advice of a financial or real estate professional before making any type of investment.